Registration Of Tds/ Tcs Deductors In Gst

Oct 19, 2018 By Admin

Section 24(vi) of GST Act, 2017 mandates for the Deductors of TDS to register under the act. Also the existing deductors under STDS/TCS under VAT will not be migrated to GST. As a result a deductor in GST will be required to get registered and obtain a GSTIN(Goods & Services Tax Identification Number) as a TDS Deductor. A deductor can register through an online process on a Govt. Portal www.gst.gov.in using their PAN/TAN.

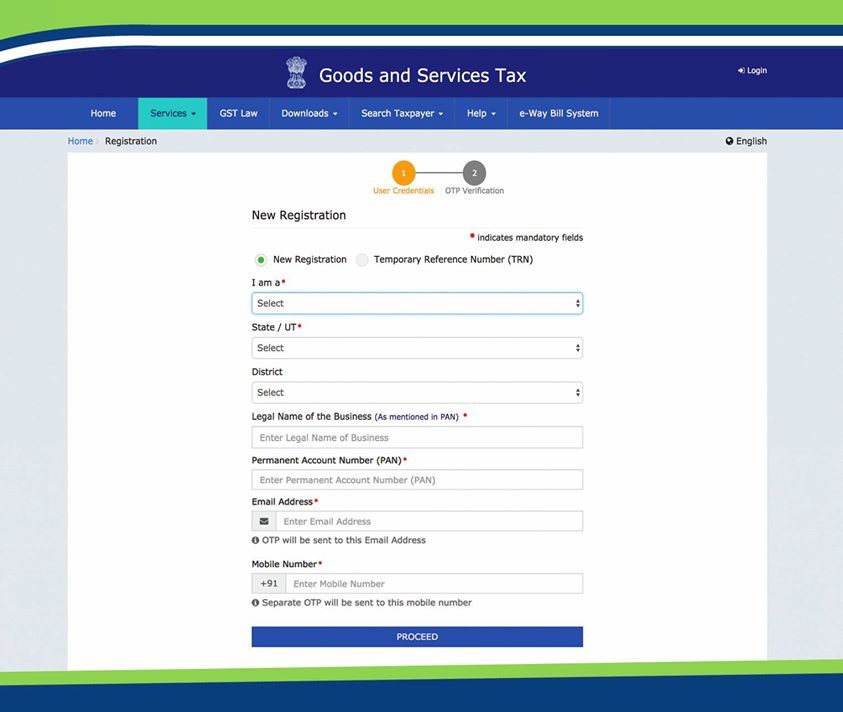

Step 1: Generating User Credentials for Registration Application.

In this step we enter our details in the form to generate Temporary Reference Number(TRN), which is used as Login Credentials later on.

Step 1.1 Entering Personal Details

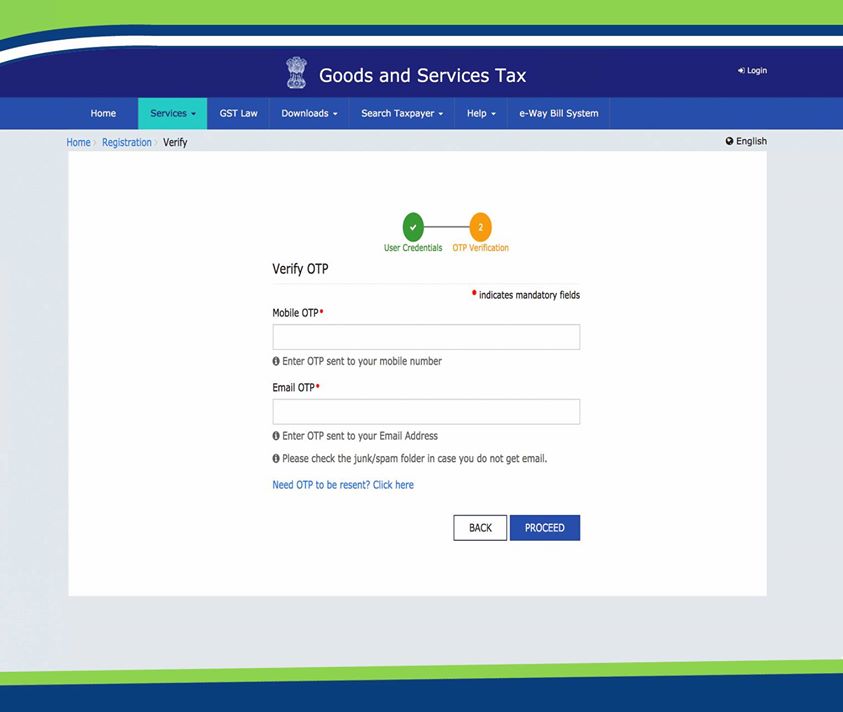

Step 1.2.1 Verifying Mobile No. & Email Id

Step 1.2.2

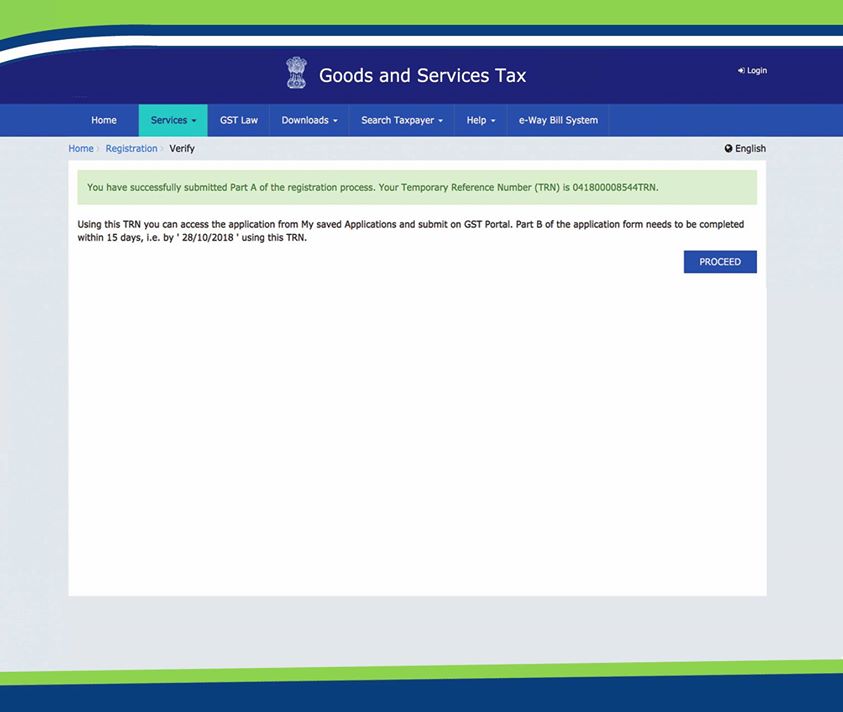

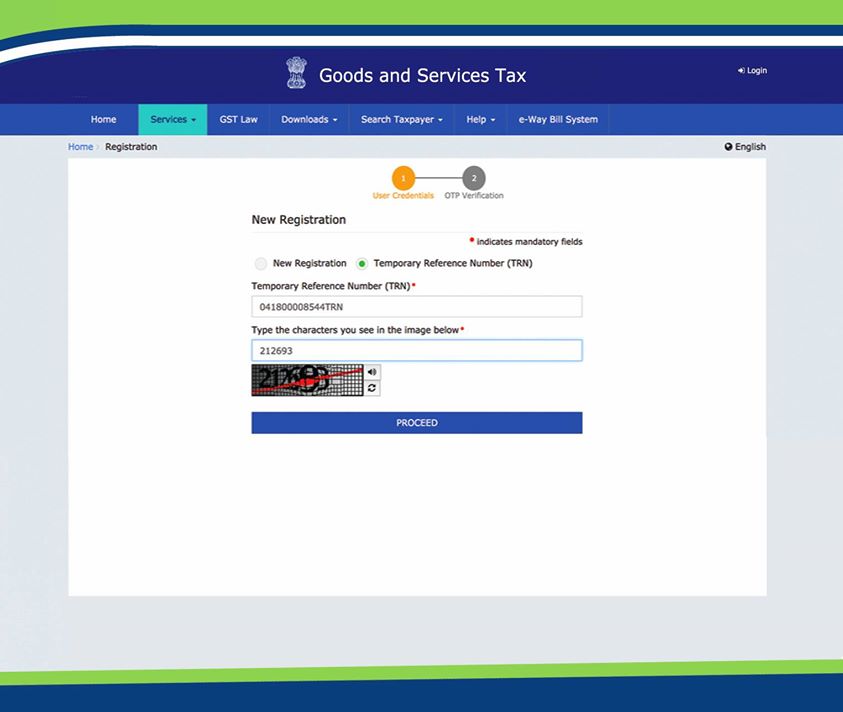

Step 2: This step involves entering login details for filling up of Registration Form through Temporary Registration Number(TRN) which we generated in Previous Step after due verification through Mobile and Email.

Step 2.1 Entering TRN for Login

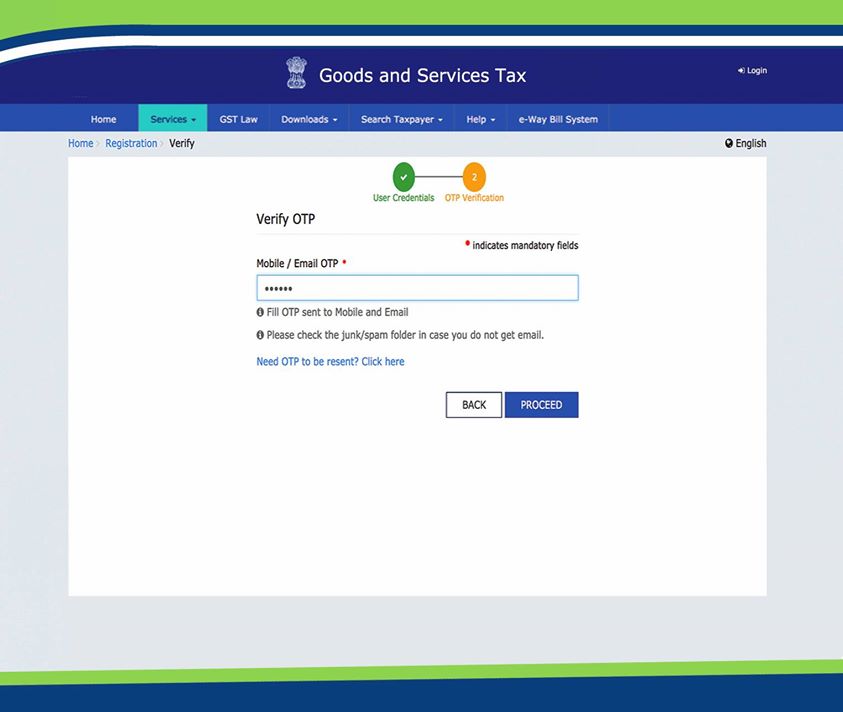

Step 2.2.1 Verification for Login into Registration Form

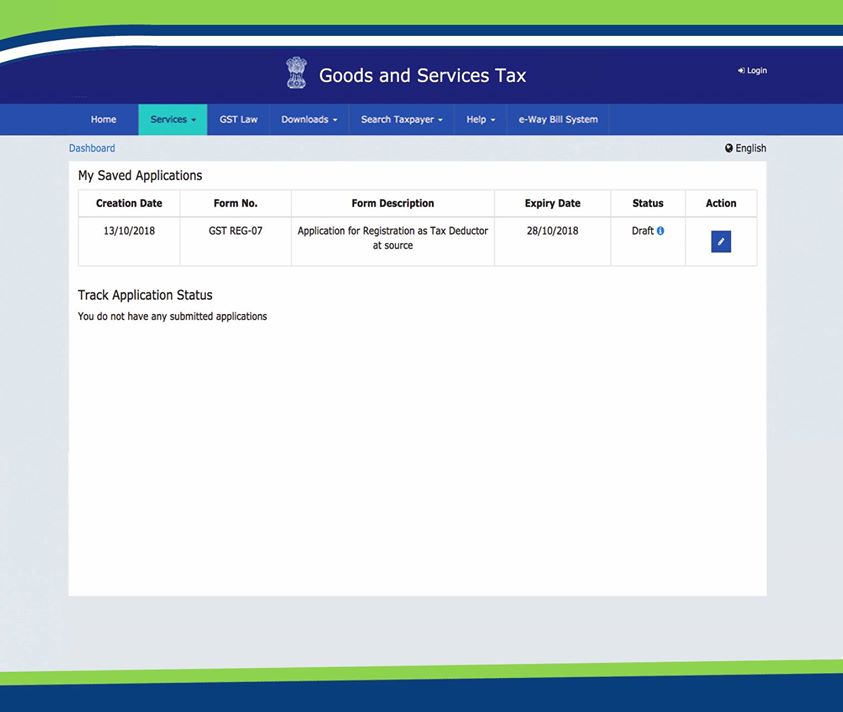

Step 2.2.2 Click blue button under 'Action' tab

Step 3: Filling up of Registration Form: Now you can fill up the Registration Form to get registered as TDS/TCS Deductor in GST.

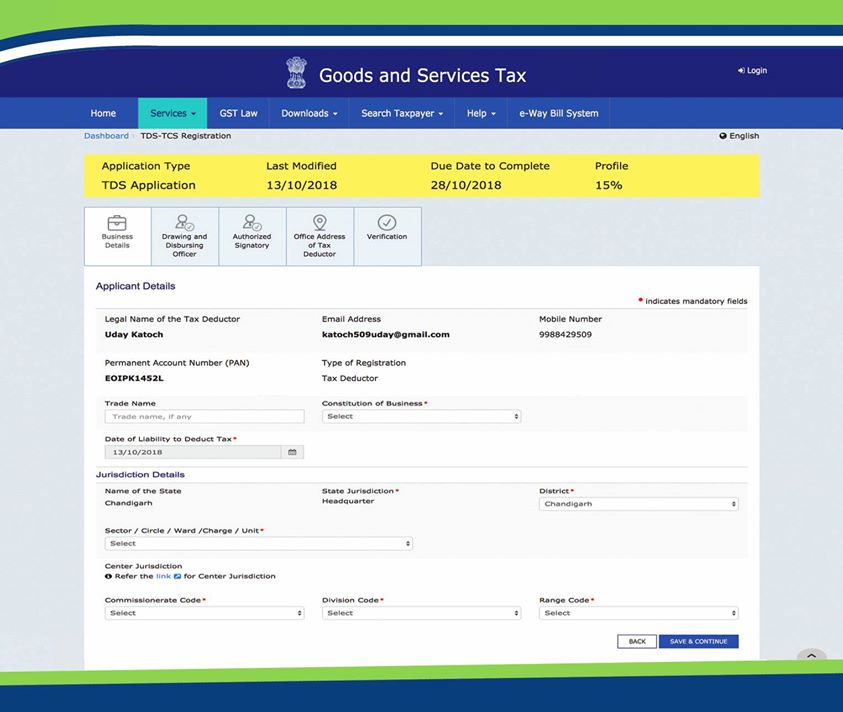

Step 3.1 Entering Business Details

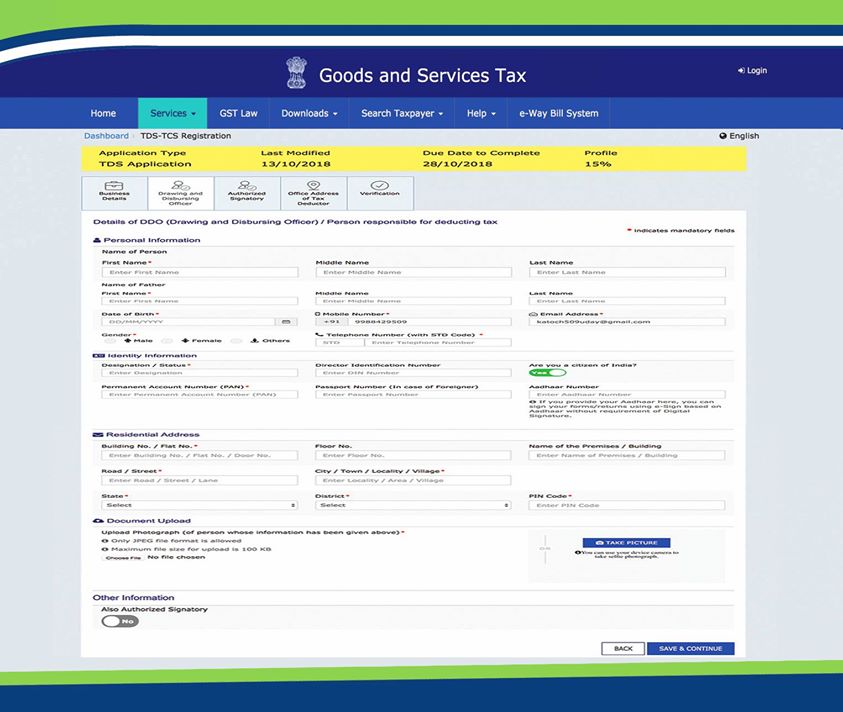

Step 3.2 Entering Details of DDO

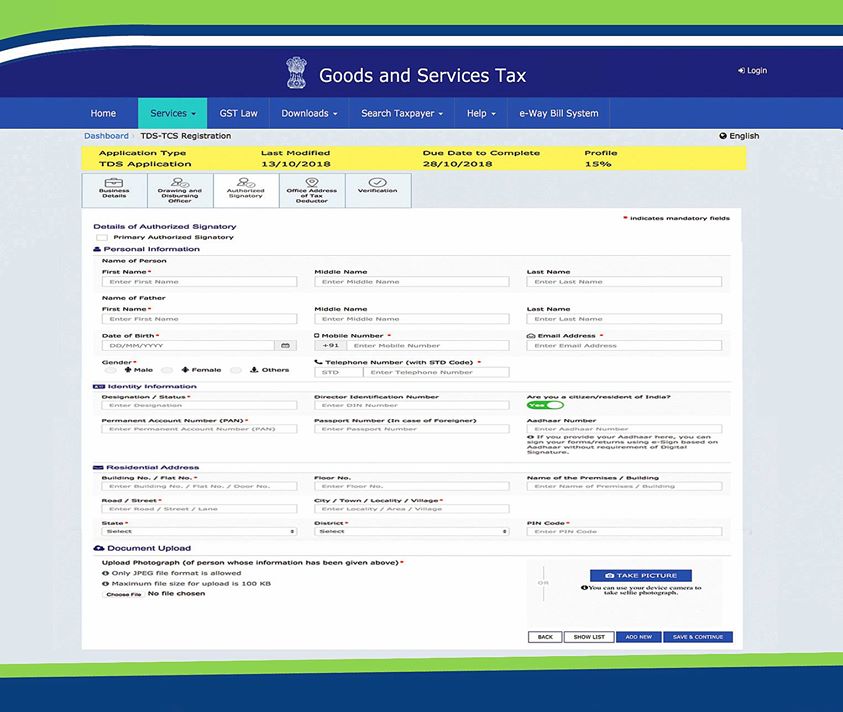

Step 3.3 Entering Details of Authorised Signatory

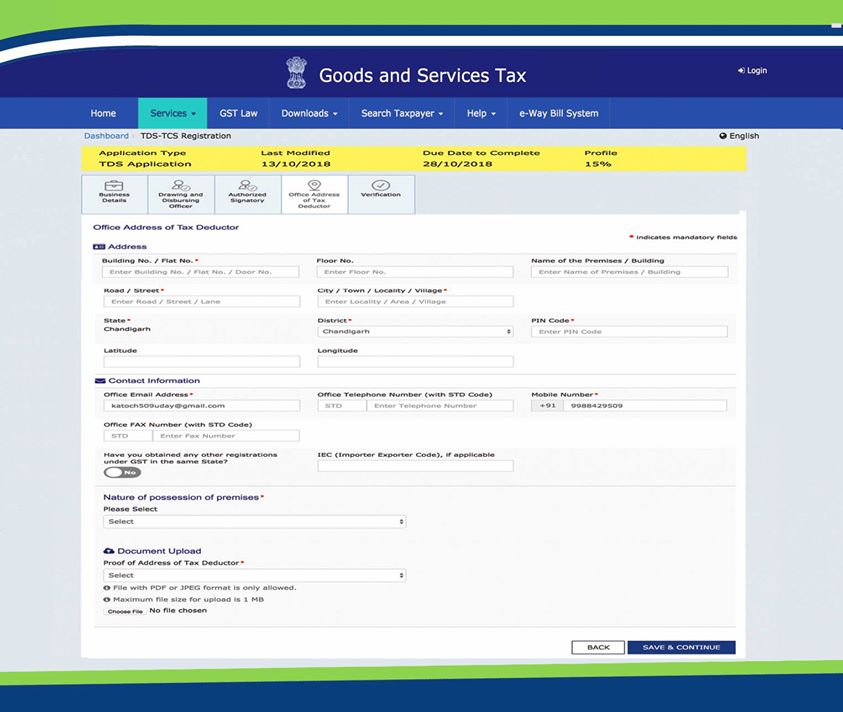

Step 3.4 Entering Office Address

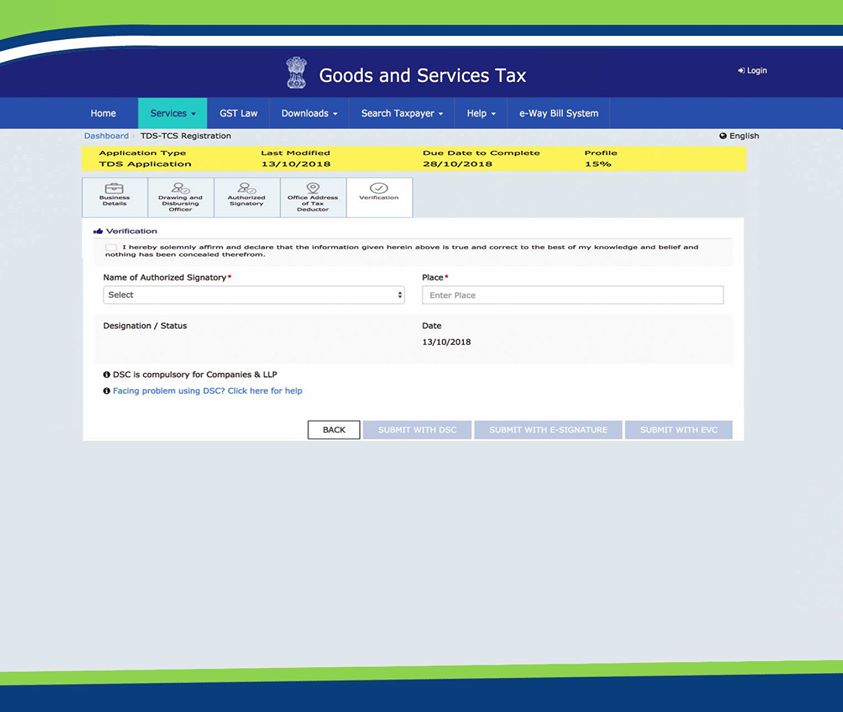

Step 3.5 Verifcation

Published by: RAKESH KANWAR & CO.

Comments: