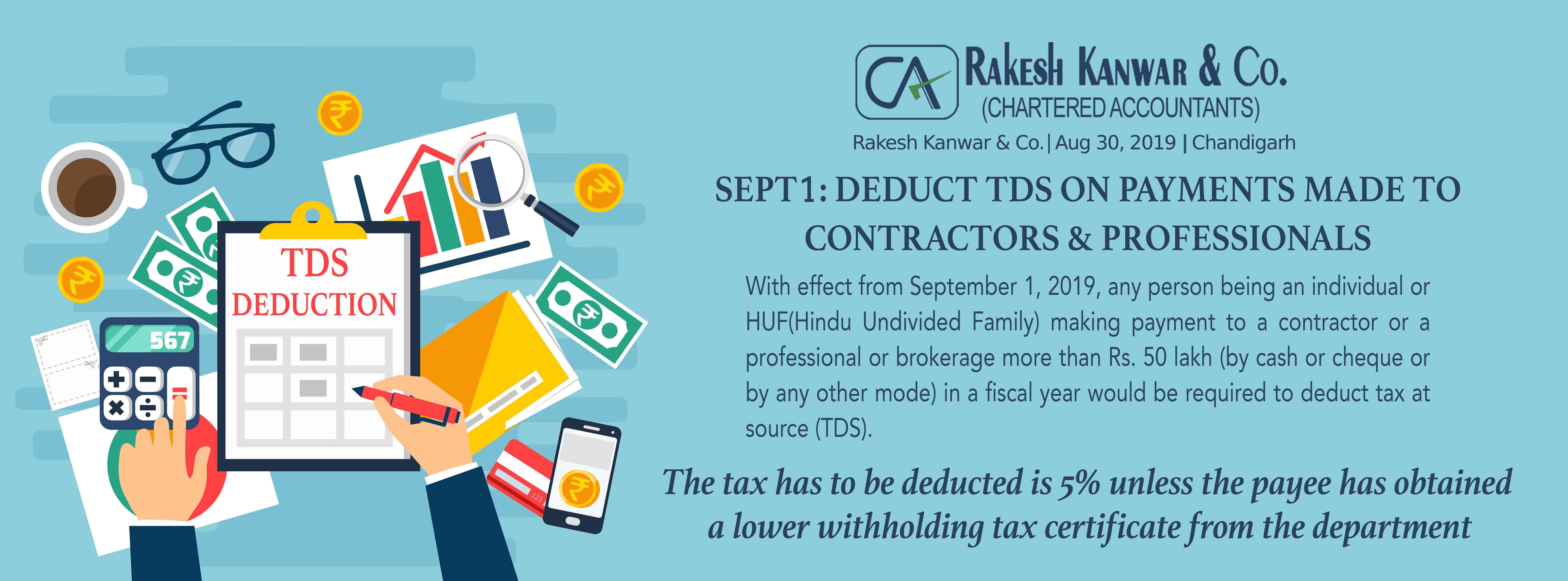

Deduct Tds On Payments To Contractors & Professionals From Sept 1

Aug 31, 2019 By Admin

With effect from September 1, 2019, any person being an individual or HUF(Hindu Undivided Family) making payment to a contractor or a professional or brokerage more than Rs. 50 lakh (by cash or cheque or by any other mode) in a fiscal year would be required to deduct tax at source (TDS) of 5% at the time of credit of such sum or at the time of payment of such sum; whichever is earlier.

This section applies only to those individuals and HUFs whose accounts are not required to be audited for tax purposes. Earlier, only individuals and HUFs who were mandatorily required to have their accounts audited as per the tax laws were required to deduct tax at source (TDS) on payments made towards contractual staff, professionals and commission or brokerage under sections 194C, 194J and 194H of the Act, respectively.

Payments made on following services are covered under this section are as follows (list isn’t exhaustive though):

1. Payment made in terms of Commission or Brokerage.

2. Payment made for professional services, i.e. to lawyers, etc.

3. Payment made to Caterers, Event Managers, different wedding vendors, etc.

4. Payment made towards construction/repair of a house.

5. Payment made towards Advertising, Broadcasting and telecasting services.

6. Payments made to Sports Persons, Umpires, Referees, Coaches, Physio, Commentators, etc.

7. Carriage of goods and passengers by any mode other than railways.

8. Manufacturing or supplying a product in accordance with requirement or specification of a customer using material purchased from such customer.

Published by: RAKESH KANWAR & CO.

For more news visit: https://www.rakeshkanwar.com/

Comments: